Banner by Charley Wan

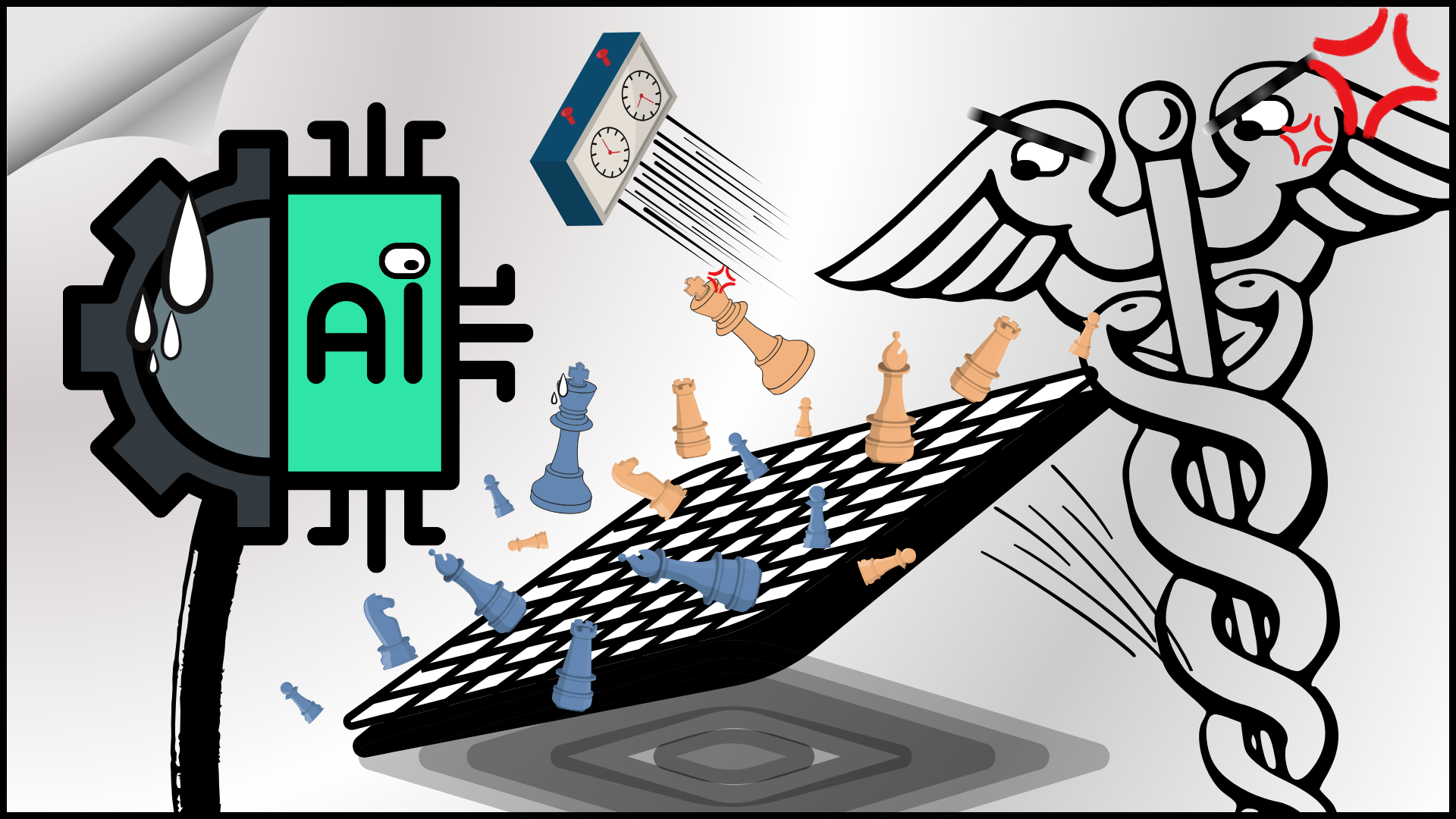

WarGames: The Battle that AI Has Initiated Between Big Tech and Big Pharma

By Amber Frantz

In a high stakes game of cat-and-mouse, Big Pharma has historically been one step ahead of the frustrated predator, Big Tech, in the lucrative maze we call the health care industry. However, with the rapid emergence of data-driven approaches coupled with the use of AI in medicine, the narrative flips: mouse does not escape cat. Without the quick embrace of AI-driven technologies, pharma stands the risk of being permanently captured and overshadowed by tech, an undesirable outcome that would transform the health care industry as we know it today.

Innovation in the digital age is driven by consumer demand with the expectation of spontaneous satisfaction. In health care, patients are consumers, and the expectation to immediately meet their needs is supported by Big Tech’s growing stake in medicine. Developing personalized therapeutics for the virtual treatment of disease and the use of AI to fuel the drug development pipeline barely scratches the surface of the promise tech giants have in reforming the healthcare industry. The lucrative health care market, estimated to rise to $15 trillion on a global scale by 2030, provides even more fuel to utilize data-driven approaches, and Big Tech is seemingly perfectly positioned to capitalize on the promotion of health literacy amongst its consumers.

Naturally, tech’s growing interest in medicine has illuminated a path to the pharma industry—a data and investment goldmine. Google’s own health care company, Verily, and the launch of Amazon Pharmacy are prime examples of the headway tech is gaining in the health care and pharmaceutical industries. With the aims of providing affordable solutions and closing the gap between clinical research and patient care, tech and pharma share many of the same goals. As combined forces, these industries would instantly synergize. However, competition for shared resources, particularly for the privacy rights of patient-specific data, drives a wedge between these two sectors, propelling them into a war for accelerating drug discovery while simultaneously meeting consumer demand.

A multitude of industries are making an effort to leverage the power of AI, and Big Pharma is no exception. From a scientific standpoint, AI technology has the potential to transform the drug discovery pipeline, streamlining the process of translating benchtop discoveries into tangible bedside treatments. This includes accelerating the virtual optimization of drug-like properties in leading compounds while incorporating the predictive power of AI to ascertain the preclinical pharmacology profiles of these early drugs. If pharma wants a chance to hold their own in the battle with Big Tech, the time is now to incorporate AI as a strategic investment in their research portfolios.

Despite a lack of experience in drug development and personalized therapeutics, the cash balance of tech giants like Amazon, Google, and Microsoft allows for rapid investment in biotech startups and AI companies. But tech’s deep pockets should not imply that collaboration with pharma is impossible. A foremost example is the collaboration between Boehringer Ingelheim and Google for the exploratory research purposes of quantum computing, a technology that relies on the power of quantum mechanics for complex problem-solving. In respect to pharmaceutical R&D, the collaborative goal is to use quantum computing in place of today’s computers that lack the functional capabilities to solve the intricate challenges of early-stage drug development, specifically in the analysis of disease mechanisms and related molecules. Furthermore, quantum computing aids in the speed of data analysis, thereby streamlining the process of launching and marketing a drug.

Yet as an alternative to collaboration, tech’s entry into the health care arena has been through the tactic of acquisitions. In 2016, Apple played its hand in the health care market through the acquisition of Glimpse, a personal health data startup that allows users to collect and share their medical information. More recently in 2022, Amazon spent $3.9 billion to acquire One Medical, a virtual healthcare service that allows users to connect immediately with primary care services. Increased investment and acquisition of healthtech will only continue into the near future, as Big Tech continues to profit from this market.

Perhaps one of the areas where Big Pharma has the high ground compared to Big Tech is in the rapid emergence of prescription digital therapeutics (PDTs). PDTs are FDA-authorized software-based treatments that are personalized to the patient via the use of a smartphone or computer . Simply put, PDTs function through the digital delivery of behavioral therapies through the use of a software application. Currently, PDTs thrive in the sector of behavioral health and are used to treat conditions such as substance use disorders and chronic insomnia. Somryst, the only FDA-approved PDT to treat chronic insomnia, recently acquired by Nox Health, uses the gold-standard method of Cognitive Behavioral Therapy for Insomnia (CBT-I) to train the brain, ultimately restoring normal sleeping patterns. Allowing its users to work through a series of exercises and lessons at their own pace, Somryst has shown clinical efficacy in randomized trials; it has been reported that 40% of Somryst-treated patients no longer met the criteria necessary of a chronic insomniac, and over 60% demonstrated a clinically meaningful response to treatment.

What makes PDTs stand out from other digital healthcare platforms is that they are only available by prescription from a licensed health professional. With the goal of evaluating and diagnosing symptoms for disease management, the AI-driven software of PDTs allows patients to take control of their treatment and provide doctors with evidence-based data to better understand and make real-time alterations to a patient’s plan of care. The longevity of PDTs in health care gives pharmaceutical companies the leverage needed to maximize the use of this technology for the development of more effective treatments. PDTs serve as the link between a patient’s needs, pharma’s goals, and a market that is profitable. With a talent portfolio that exceeds Big Tech’s experience in the pharmaceutical industry, pharma companies must take the lead in bringing PDTs to all areas of health care in order to truly tailor precision medicine to the individual.

While the collaboration between Big Tech and Big Pharma has unprecedented potential, Big Pharma stands the risk of being overshadowed if it does not quickly embrace AI-driven technologies to accelerate therapeutic outcomes. Addressing unmet medical needs has been the war chant of Big Pharma since the dawn of the pharmaceutical industry. Given current consumer demand and the profitable market of AI-based innovations such as PDTs, the time for pharma to enter this new foray is now. The only question that remains is: who will emerge victorious from this modern-day wargame?